Learn how to start your Pegasus Angel with this comprehensive tutorial covering API keys, settings, and management.

Getting Started with Pegasus Angel

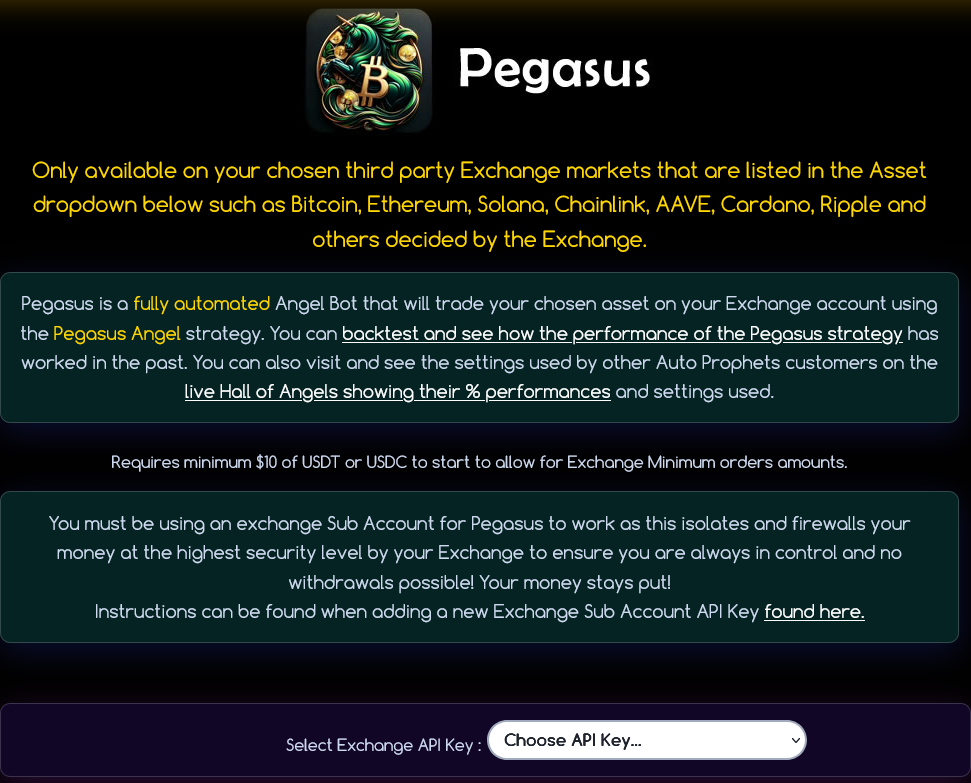

Pegasus is a fully automated Angel Bot that trades your chosen asset on your Exchange account using the advanced Pegasus strategy. You can backtest and see the historical performance of the Pegasus strategy. You can also visit the live Hall of Angels to see real customer performance and settings.

Want to understand minimum order sizes, contract specifications, and market rules for each exchange? Check out our comprehensive Market Rules Guide to see all available inverse perpetual markets.

Requires minimum $10 USD in USDT or USDC to start, allowing for Exchange minimum order amounts.

Essential Strategy Guide - Smart Balance Management

Before you start your Angel, understanding these core principles will help you make better decisions and avoid common mistakes that lead to losses.

The Pegasus Strategy is designed for patience, not panic. It uses the full drawdown space available and positions stop losses strategically underneath maximum drawdown levels. This allows the strategy to ride through normal market volatility without unnecessary stops.

✓ Success Approach: Let the strategy work through temporary dips

✗ Common Mistake: Stopping frequently due to short-term losses

What it does: Automatically transfers additional balance from your Funding Account when your profit percentage drops below a set threshold.

How to use it effectively:

- Set it 10% above your Stop Loss: If Stop Loss is -95%, set Backup Plan at -85%

- Keep funds ready: Maintain USDT/USDC in your ByBit Funding Account

- Monitor your balance: The system will notify you when it activates

When to add more balance: If you see your Angel approaching the liquidation price or if you want to give it more room during market downturns.

Step-by-step process:

- Step 1: Transfer USDT/USDC to your Sub Account Unified area

- Step 2: The Angel automatically detects new balance within 1-2 minutes

- Step 3: Watch how this pushes your liquidation price further down

- Step 4: Use the liquidation calculator in Angel Settings to see the impact

If a -95% Stop Loss feels too risky, consider these approaches:

✓ APPROACH A

Reduce your balance allocation

Use less money so a -95% loss is acceptable to you

✗ APPROACH B

Using a tighter Stop Loss

Historical data shows frequent stops accumulate losses

Market Reality: Cryptocurrency markets are highly volatile. Historical data shows prices can drop 20-40% and recover within days or weeks. This is educational analysis only - not financial advice.

Example of Strategy that has Poor Results Long Term:

Starting Capital: $1,000

• Set -20% Stop Loss → Gets triggered → Balance: $800 (-$200)

• Restart with $800 → Another -20% stop → Balance: $640 (-$160)

• Restart with $640 → Another -20% stop → Balance: $512 (-$128)

• Restart with $512 → Another -20% stop → Balance: $410 (-$102)

Result: $590 total loss (59% down) from "small" 20% stops

Example of Strategy that has Good Results Long Term:

Starting Strategy: $300 active + $700 backup reserve

• Set -95% Stop Loss on $300 → Market drops 40% → Still running

• Add $200 backup when needed → Liquidation pushed further down

• Market recovers (as historical data shows) → Angel continues working

Result: Strategy survives volatility, backup plan ready

Advanced Strategy Example - Staged Deployment:

Total Available: $1,000 - Smart Allocation:

• Phase 1: Start with $250 → Test market conditions

• Phase 2: If market drops, add $250 → Dollar cost average down

• Phase 3: Keep $500 as final backup → For major market events

Result: Multiple safety nets, positioned for recovery

How professional traders handle market volatility:

- Never go "all in": Always keep reserves for opportunities

- Buy dips systematically: Add to positions when prices are cheaper

- Plan for black swan events: Real-world events cause crashes, but recovery follows

- Study historical patterns: Use data to understand market cycles

💡 Research Tool: Use our Pegasus Backtest to analyze maximum drawdown for your chosen market. See for yourself how tight stop losses perform versus wider ones during historical market cycles.

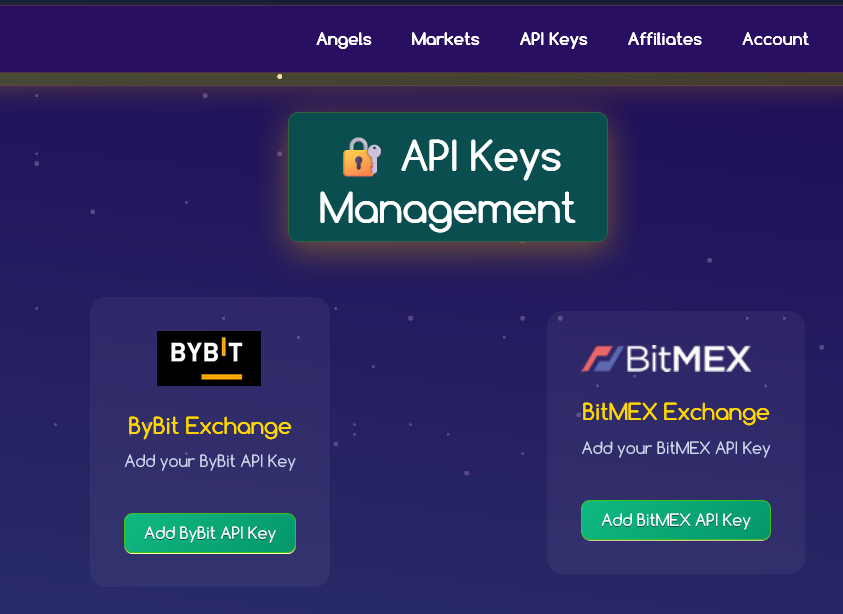

Add Your Exchange API Key

Before starting your Pegasus Angel, you need to add an Exchange API Key from a Sub Account. This isolates and firewalls your money at the highest security level by your Exchange, ensuring you are always in control with no withdrawal capabilities.

You must use an Exchange Sub Account for Pegasus to work safely. Your money stays secure and withdrawals are not possible through the API.

Choose your exchange and follow the detailed setup instructions:

To add your API Key, make sure you are logged into your Dashboard:

- Click on "API Keys" in the top navigation menu

- Click on "Your Exchange"

- Follow the directions on the screen to add the API Key.

Navigate to Start New Angel

Once you have added your API key, follow these steps to start your Angel:

- Click on "Angels" in the top navigation menu

- Click on "Start New Angel" in the left navigation panel

- You will see the Pegasus Angel option available for selection

Configure Your Pegasus Strategy Settings

API Key and Market Selection

First, select your Exchange API Key from the dropdown and choose your trading asset from the available markets (Bitcoin, Ethereum, Solana, and others as supported by your chosen exchange).

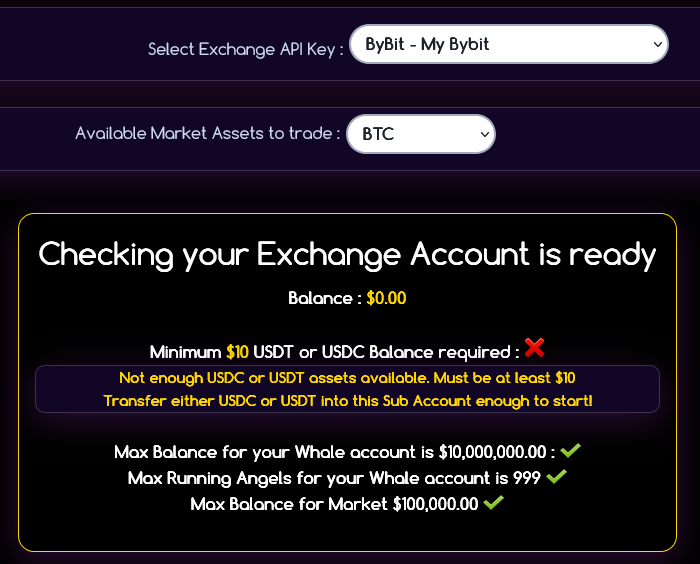

Account Readiness Check

The system will automatically verify that your Exchange Account is ready:

- Sufficient balance for minimum requirements

- API key permissions are correct

- Sub Account is properly configured

- No conflicting positions or coins

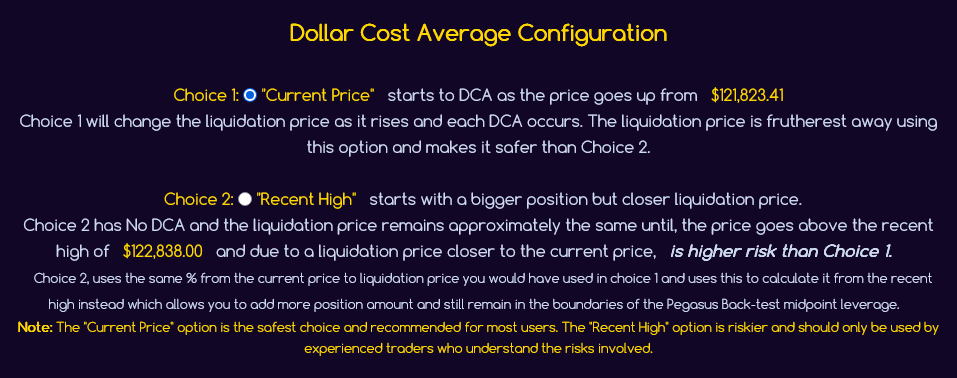

Dollar Cost Average (DCA) Configuration

Choose between two DCA methods:

Starts DCA as the price goes up from current price. The liquidation price changes and moves further away with each DCA, making it the safer option.

Starts with a bigger position but closer liquidation price. No DCA until price goes above recent high. Higher risk due to closer liquidation price.

Target Leverage Setting

Adjust your target leverage using the slider or input field. You can use the Pegasus Back-test to explore different leverage settings and their historical outcomes to inform your decision.

Trading with leverage is risky and you can lose all your money. The liquidation price shows where your trade will close and you will lose your balance. Only use money you can afford to lose!

Advanced Configuration Options

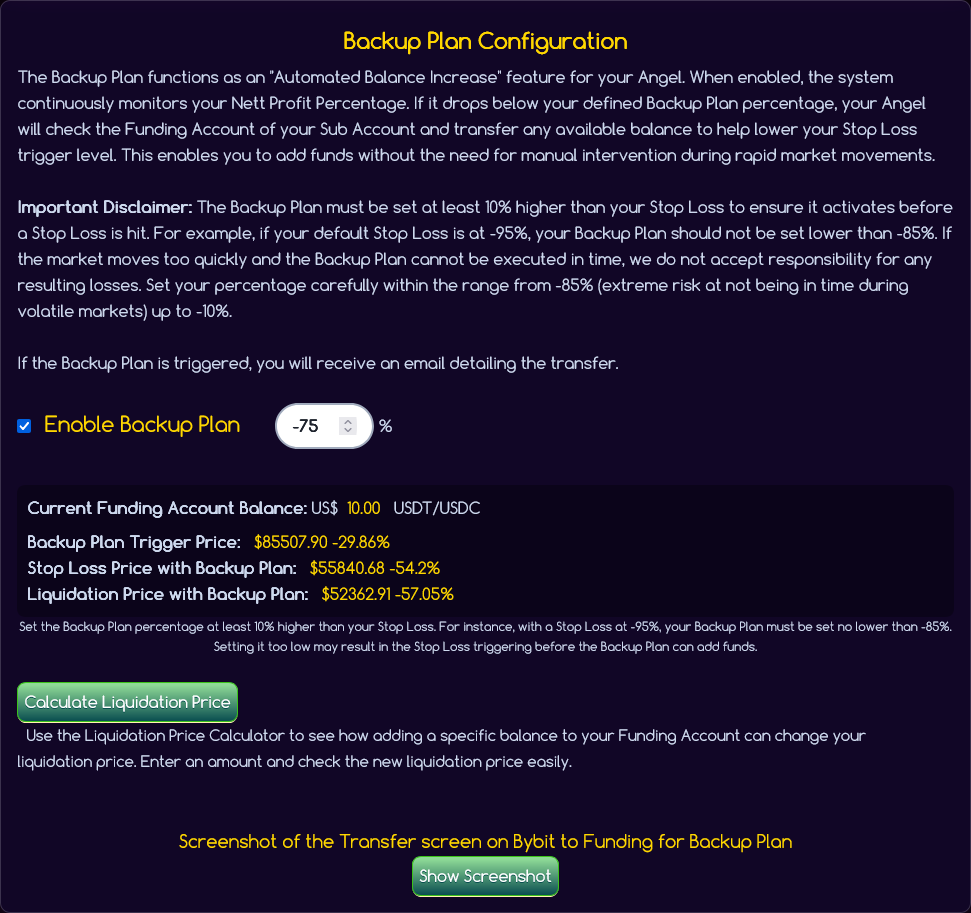

Backup Plan Configuration

The Backup Plan functions as an "Automated Balance Increase" feature. When enabled, the system monitors your Nett Profit Percentage and transfers available balance from your Funding Account if it drops below your defined percentage.

ByBit Only: The Backup Plan is only available for ByBit customers as ByBit has a "Funding" account within the sub-account structure. BitMEX does not support this feature due to different account architecture.

The Backup Plan must be set at least 10% higher than your Stop Loss. For example, if your Stop Loss is -95%, your Backup Plan should not be lower than -85%.

When you have funds in your ByBit Funding Account and enable the Backup Plan, the system will perform an additional verification step during setup.

If the system detects available USDT or USDC in your ByBit Funding Account, you'll see a confirmation screen asking if you want to use these funds for your Backup Plan. This happens automatically during the account readiness check.

What happens next:

- Confirmation Required: You'll be asked to confirm whether you want to utilize the detected funds for backup purposes

- Automatic Return: After confirming, the system returns you to the Configuration screen

- Updated Display: Your Backup Plan section will now show the available funding balance and lets you see the Liquidation price after the backup funding amount was added. You can also use the "Calculate the Liquidation Price" to adjust and play and see whata settings would be if you put custom amounts in the Funding account.

- Ready to Continue: You can then proceed with finalizing your Angel settings

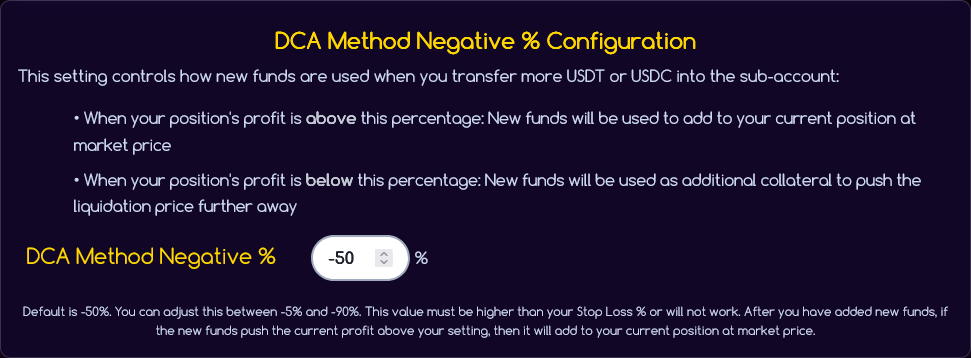

DCA Method Negative % Configuration

This setting controls how new funds are used when you transfer more USDT or USDC:

- Above this percentage: New funds add to your current position at market price

- Below this percentage: New funds are used as additional collateral to push liquidation price further away

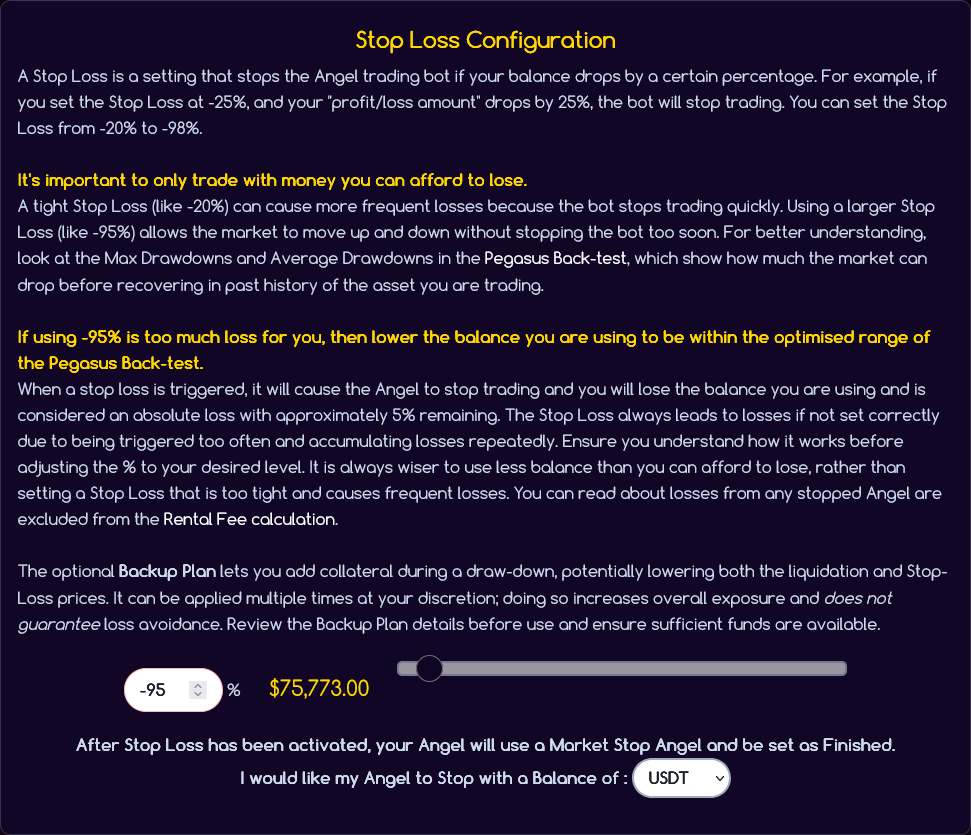

Stop Loss Configuration

A Stop Loss stops the Angel if your balance drops by a certain percentage. You can set it from -20% to -98%. Using a larger Stop Loss (like -95%) allows for market volatility without stopping the bot prematurely.

If using -95% Stop Loss feels like too much potential loss, reduce the balance you're using rather than setting a tight Stop Loss that triggers frequently. Frequent Stop Loss triggers accumulate losses over time.

Understanding Stop Loss Psychology (Not Financial Advice):

Common Thinking: "I'll set a -30% stop loss to 'protect' my money"

Market Reality: Crypto can drop 30% in a day and recover the next week

Mathematical Result: You lock in losses during normal market movement

Alternative Approaches to Consider:

APPROACH A

Wide stop loss (-95%) + Smaller position

Allows strategy to work through volatility

APPROACH B

Staged deployment + Reserve funds

Add funds when prices are cheaper

Historical Market Events Example:

• COVID-19 March 2020: Bitcoin dropped 50% in 2 days

• FTX Collapse Nov 2022: Market dropped 25% in 1 week

• China Mining Ban 2021: 40% drop over 2 weeks

Pattern: Real-world events cause crashes, recovery follows

💡 Research Suggestion: Use the Pegasus Backtest tool to analyze maximum drawdown for your chosen market. See how different stop loss percentages performed during historical volatility periods. This helps you make informed decisions based on data rather than emotions.

Trailing Take Profit Configuration

This feature helps lock in profits as they increase. When your profit reaches the set percentage, it starts tracking and will sell if profits drop by the specified percentage from the highest point.

- Price Percentage: Tracks highest price and triggers if price falls by set percentage

- PNL Percentage: Tracks highest profit and triggers if profits drop by set percentage

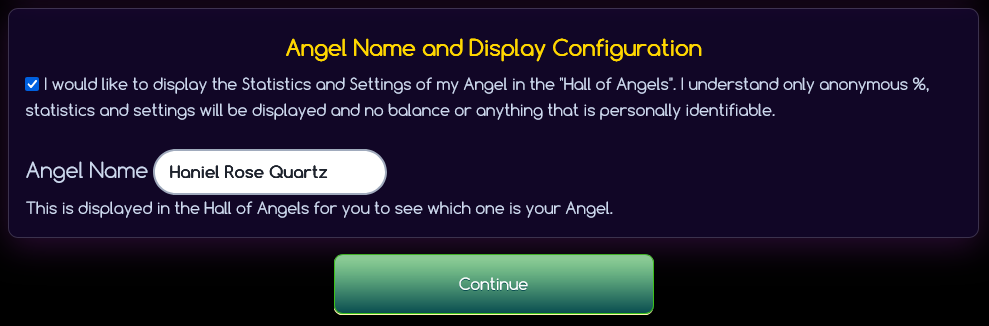

Angel Name and Hall of Angels

Choose a name for your Angel and decide whether to display it in the Hall of Angels (only anonymous statistics and settings are shown, no balance or personal information).

Confirm Settings and Start Your Angel

Review all your configuration settings in the confirmation screen. You'll see a summary of:

- Angel name and strategy algorithm

- Selected API key and market symbol

- Balance allocation and leverage settings

- DCA configuration and backup plan details

- Stop Loss and Trailing Take Profit settings

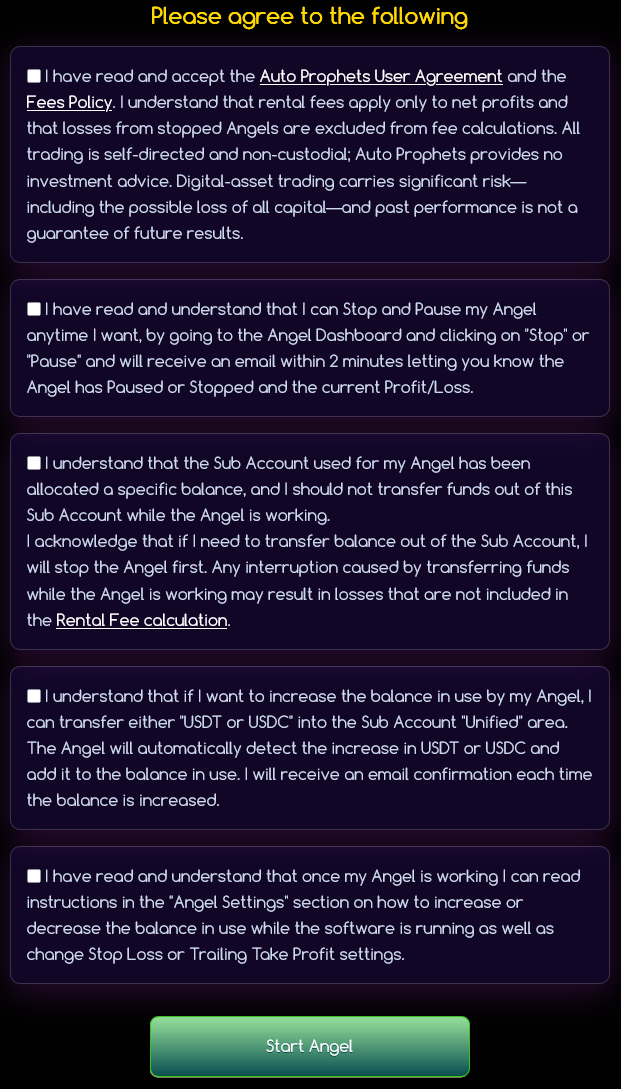

If you need to make changes, click "Change Settings" to return to the configuration. Once satisfied, scroll down to read and agree to the terms:

- ✓ Auto Prophets User Agreement and Fees Policy

- ✓ Understanding of Stop functionality (no Pause option available)

- ✓ Sub Account balance management rules

- ✓ Balance increase procedures

- ✓ Angel Settings management

After agreeing to all terms, click "Start Angel" to begin your automated trading.

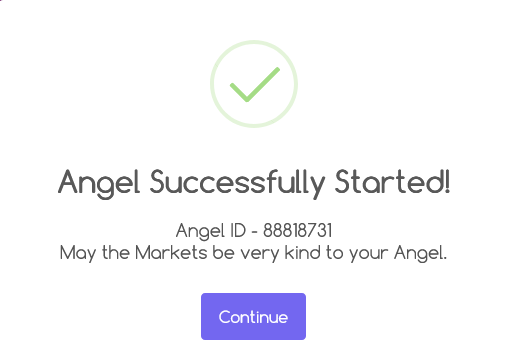

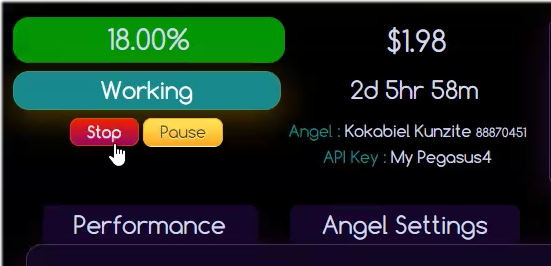

Using Your Angel Dashboard

Congratulations! Your Angel is now running. The Angel Dashboard provides comprehensive monitoring and management capabilities:

Performance Monitoring

The dashboard displays key metrics including:

- Current profit/loss percentage and amount

- Position value and liquidation price

- Stop Loss and Trailing Take Profit status

- Running time and angel status

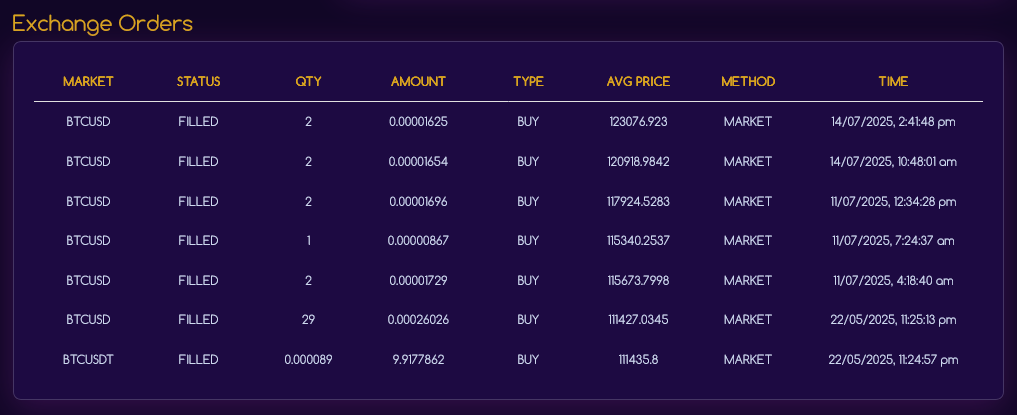

Exchange Orders Section

View all orders placed by your Angel, including spot and futures orders, position additions, and dollar cost averaging activities.

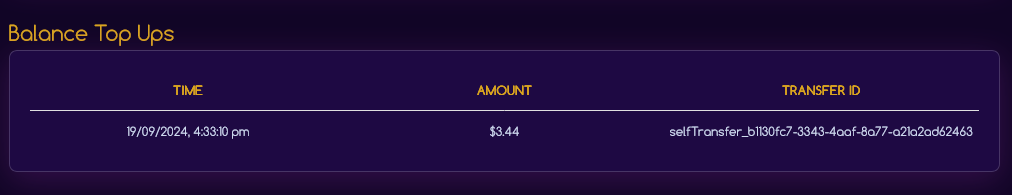

Balance Top-Ups Section

Monitor balance increases when you transfer USDT or USDC into your Sub Account Unified area. The Angel automatically detects and incorporates new balance.

Angel Settings Tab

Access the Angel Settings tab to:

- Increase or decrease balance with detailed instructions

- Adjust Trailing Take Profit settings

- Modify Stop Loss percentage

- Update Hall of Angels display settings

- Connect Telegram for real-time notifications

For comprehensive information about using all Angel Settings features, including balance management calculators, backup plan configuration, and advanced monitoring tools, visit our Angel Settings Tutorial.

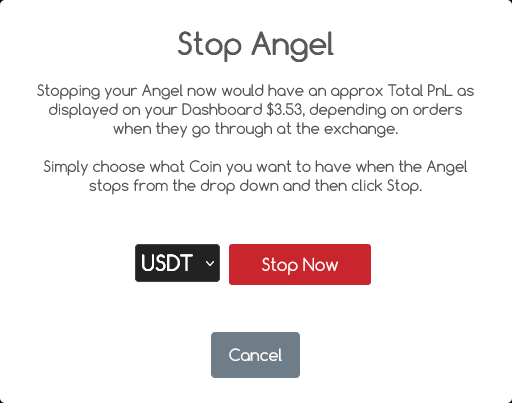

Angel Control: Stop and Management

Your Angel Dashboard provides complete control over your automated trading:

Stop Function

Permanently stops the Angel and closes all positions, converting everything to your chosen base currency (USDT/USDC or the Asset such as BTC, ETH etc). This process takes up to 2 minutes and you'll receive a notification email when completed.

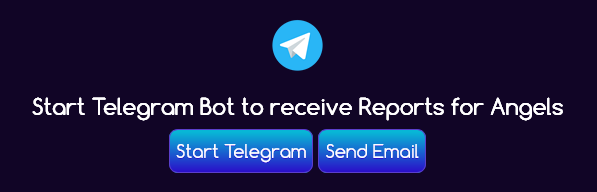

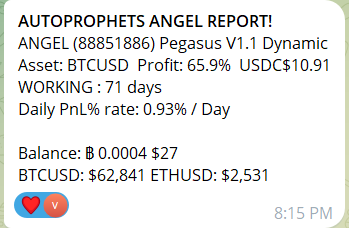

Telegram Integration

Connect your Telegram account to receive:

- Real-time Angel performance reports

- Balance increase confirmations

- Stop Loss or Trailing Take Profit notifications

- Backup Plan activation alerts (ByBit only)

Getting Help and Support

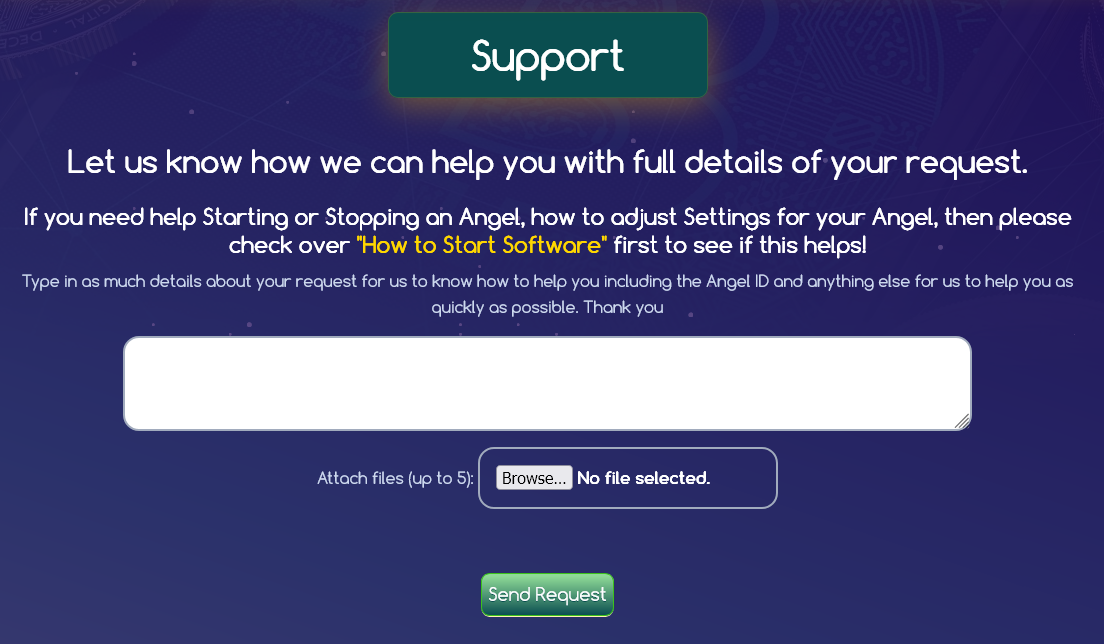

If you need assistance, use the comprehensive support system:

- Click "Support" in the top navigation

- Provide detailed description of your issue

- Attach screenshots or images if needed

- Include specific details for faster resolution

Always mention exact details of what you need help with, including Angel name, exchange used, and specific error messages if any.

Important Disclaimers and Risk Information

All trading carries significant risk, including the potential loss of all capital. Auto Prophets provides no investment advice, and all trading decisions are self-directed. Past performance does not guarantee future results. Only trade with money you can afford to lose completely.

Trading with leverage amplifies both gains and losses. The liquidation price represents the point where your entire position will be closed automatically. Always understand your liquidation risk before starting.

Rental fees apply only to net profits. Losses from stopped Angels are excluded from fee calculations. Review the complete Fees Policy for detailed information.